As high home prices and mortgage rates force many homeowners to stay put rather than trade-up, a whopping 90% of homeowners are looking to make their existing living space more comfortable this year, according to a new survey.

But as inflation continues to drive up material costs, many are turning to DIY projects to save money.

For instance, while the consumer-price index, a measure of inflation, moderated to 6.4% in January from a year earlier, the cost of floor coverings rose 13.1%, and the prices of tools, hardware and supplies went up by 11.8 %, according to data released earlier this week by the Labor Department.

How are homeowners handling rising costs of home improvement projects?

In a survey of nearly 3,700 American homeowners by Today’s Homeowner, nearly 28% of respondents said they were planning to spend “significantly” less compared to last year, 90% of homeowners said they were planning to tackle at least one home renovation project this year.

“If you wanted to get new furniture or if you wanted to paint your house, or if you wanted to put new siding up outside, if you wanted to build a deck, really anything related to improving your home, we found that this category, was about 10% more expensive,” Hailey Neff, a researcher on the survey told USA TODAY. “For a lot of homeowners, DIY project has become a more more affordable way of doing it.”

Homeowners in some states are tightening their purse strings more than others. More than 60% of homeowners in four states (Connecticut, Wisconsin, New Mexico, and Nebraska), 60% said they plan to reduce their spending on home improvement projects in 2023.

With these projects, many homeowners are generally looking to improve their living space. Nearly 69% of respondents list this as a primary reason for wanting to complete their planned home improvement projects in 2023. The next-most popular reason for wanting to complete one or more renovations is to fix something broken (53.1% of respondents).

Only about 13% of homeowners list renovations prior to listing a home for sale as one of their primary reasons for taking on improvement projects.

How are homeowners paying for home improvement projects?

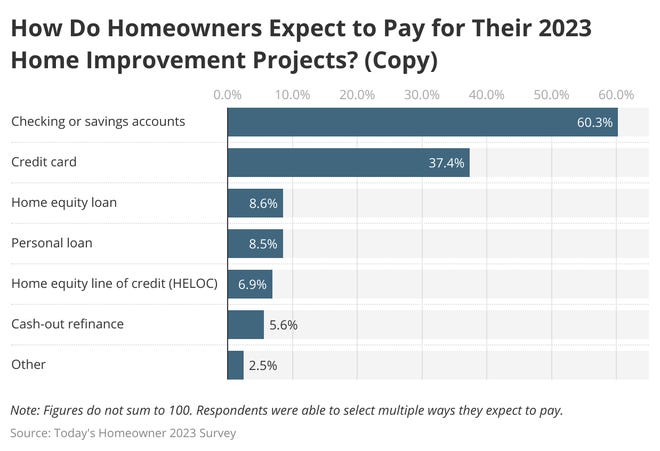

Roughly 60% of respondents said they expect to pay for projects using money from checking and savings accounts (60%). Additionally, 37% of homeowners cite credit cards as one of the ways they will pay for improvement projects.

Fewer homeowners expect to turn to financing options, and of those, nearly 9% report home equity and personal loansas their preferred choices.

Due to volatile and elevated mortgage rates, fewer homeowners are interested in a home equity line of credit (HELOC) or cash-out refinancing as ways to fund their home improvement. In a HELOC, interest rates are generally variable, meaning that homeowners may be on the hook to pay a higher rate if interest rates continue to rise. Meanwhile, a cash-out refinance is only beneficial when current mortgage rates are lower than the existing rate, which may not be the case for many homeowners today, according to Todays Homeowner.

DIY your home improvement project?

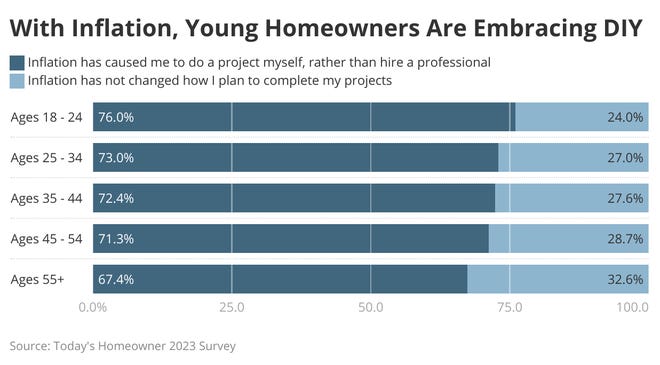

About 71% of homeowners say that inflation has caused them to do a project themselves rather than hire a professional.

The trend is even more pronounced for Gen Z and Millennials. Roughly 76% of homeowners between the ages of 18 and 24 are doing a project themselves rather than hiring a contractor due to inflation. For those under 44, that number is close to 73%.

The survey also found that homeowners in remote areas seem to prefer DIY, perhaps indicating a difficulty in finding nearby professionals. Eight of the top 10 states with the most DIY-leaning homeowners in this study have a population of five million or less.

Swapna Venugople Ramaswamy